OFFICE OF

THE INSPECTOR GENERAL

SOCIAL SECURITY ADMINISTRATION

SINGLE AUDIT OF THE

DEPARTMENT OF THE FAMILIY

FOR THE FISCAL YEAR

ENDED JUNE 30, 2007

August 2009 A-77-09-00012

By conducting independent and

objective audits, evaluations and investigations, we inspire public confidence

in the integrity and security of SSA’s programs and operations and protect them

against fraud, waste and abuse. We provide

timely, useful and reliable information and advice to Administration officials,

Congress and the public.

Authority

The Inspector General Act created

independent audit and investigative units, called the Office of Inspector

General (OIG). The mission of the OIG,

as spelled out in the Act, is to:

m Conduct

and supervise independent and objective audits and investigations relating to

agency programs and operations.

m Promote

economy, effectiveness, and efficiency within the agency.

m Prevent

and detect fraud, waste, and abuse in agency programs and operations.

m Review

and make recommendations regarding existing and proposed legislation and

regulations relating to agency programs and operations.

m Keep

the agency head and the Congress fully and currently informed of problems in

agency programs and operations.

To

ensure objectivity, the IG Act empowers the IG with:

m

m Access

to all information necessary for the reviews.

m Authority

to publish findings and recommendations based on the reviews.

Vision

We strive for

continual improvement in SSA’s programs, operations and management by

proactively seeking new ways to prevent and deter fraud, waste and abuse. We commit to integrity and excellence by

supporting an environment that provides a valuable public service while

encouraging employee development and retention and fostering diversity and

innovation.

Date: August 20, 2009 Refer To:

To: Candace

Skurnik

Director

Audit Management and Liaison Staff

From: Inspector General

Subject: Management Advisory Report: Single Audit of the

This report presents the Social

Security Administration’s (SSA) portion of the single audit of the

The audit firm Torres Llompart,

Sanchez Ruiz L.L.P. performed the audit.

We have not received the results of the desk review conducted by the U.S.

Department of Agriculture (USDA). We

will notify you when we receive the results if USDA determines the audit did

not meet Federal requirements. In

reporting the results of the single audit, we relied entirely on the internal

control and compliance work performed by Torres Llompart, Sanchez Ruiz L.L.P.,

and the reviews performed by USDA. We

conducted our review in accordance with the Quality

Standards for Inspections issued by the President’s Council on Integrity

and Efficiency.[1]

For single audit purposes, the

Office of Management and Budget (OMB) assigns Federal programs a Catalog of

Federal Domestic Assistance (CFDA) number.

SSA’s Disability Insurance (DI) and Supplemental Security Income (SSI)

programs are identified by CFDA number 96.

SSA is responsible for resolving single audit findings reported under

this CFDA number.

The Puerto Rico Disability

Determination Services (DDS) performs disability determinations under SSA’s DI

program in accordance with Federal regulations.

The Puerto Rico DDS is reimbursed for 100 percent of allowable

costs. The PRDF is the Puerto Rico DDS’

parent agency.

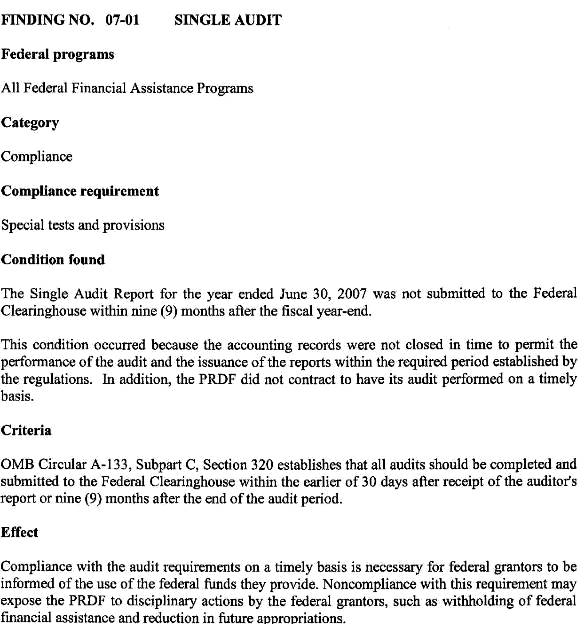

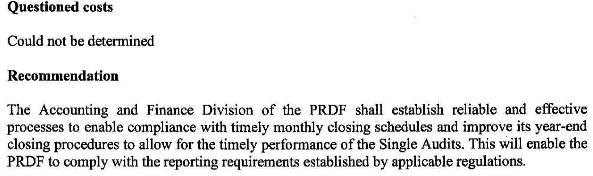

The single audit reported PRDF:

1.

Did not submit the single audit report

to OMB’s Federal Audit Clearinghouse within 9 months after the fiscal

year-end (Attachment A, Page 1). The corrective action plan[2]

indicates PRDF will establish reliable and effective processes to comply with

the reporting requirements.[3]

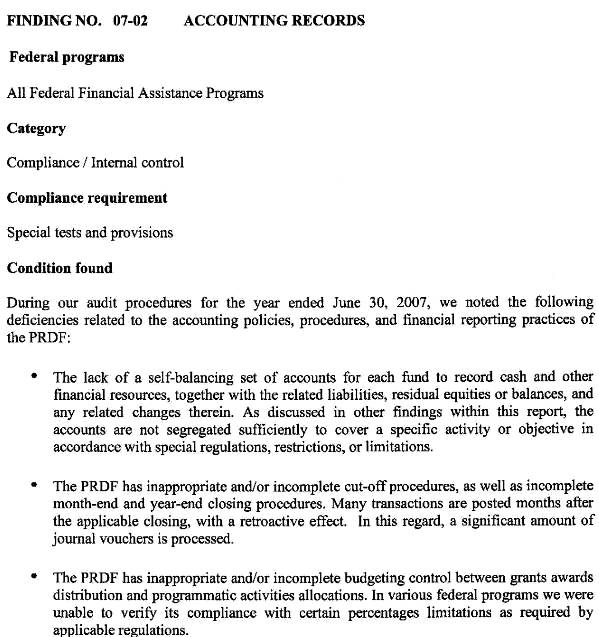

2.

Had deficient accounting policies,

procedures, and financial reporting practices including a lack of a self-balancing

set of accounts, inappropriate, and/or incomplete monthly and year-end

closing procedures (Attachment A, Pages 2 through 4). The corrective action plan indicated that a customized

application system was being developed that will provide accurate and complete

financial and budgetary information.3

3.

Had an inadequate filing system that did

not permit the prompt retrieval of payment and other documents requested (Attachment

A, Pages 5 and 6). The corrective action plan indicated a Document

Control System was developed that includes a Central File Division to maintain the

supporting documents of all fiscal transactions.3

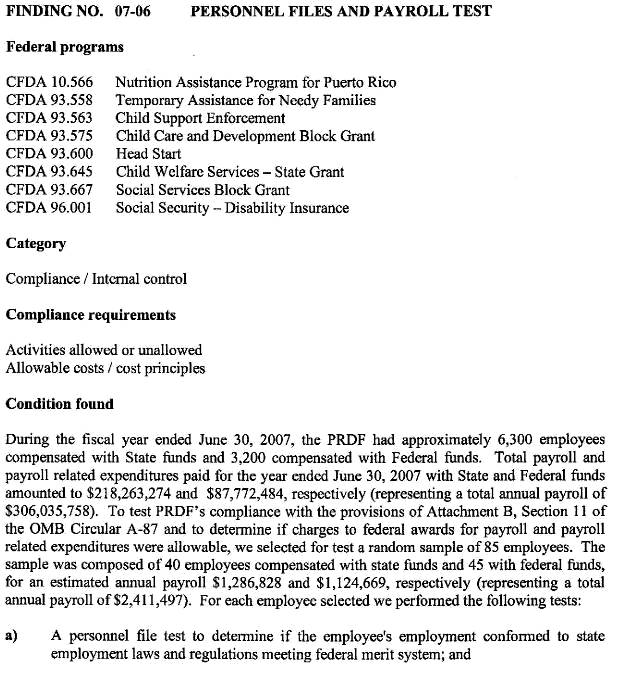

4.

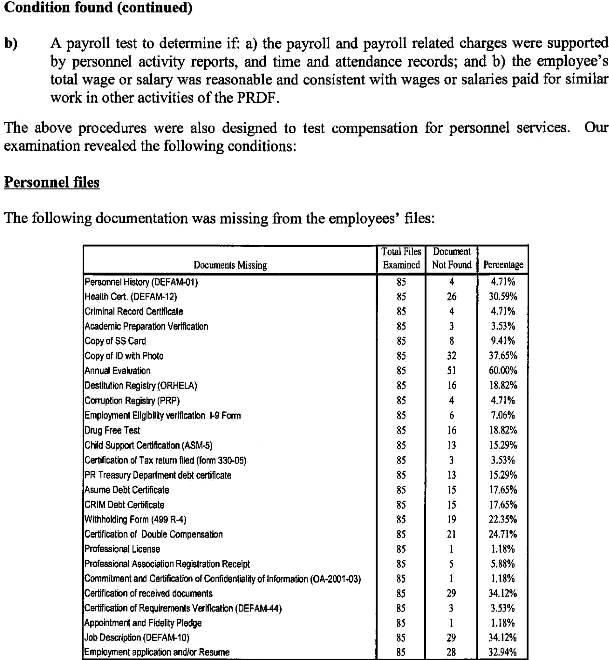

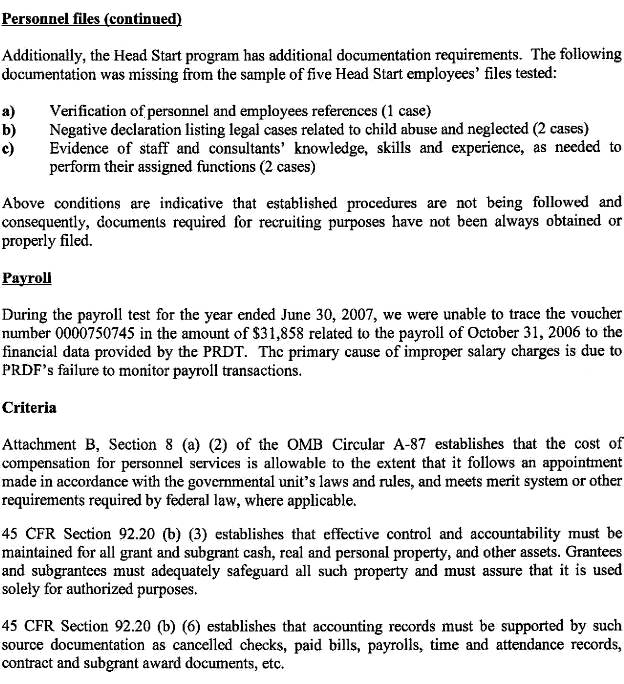

Had multiple documents missing

from personnel files and payroll transactions that were not being properly

monitored (Attachment A, Pages 7 through 10). The corrective action plan indicated that a taskforce was

organized to review 3,000 personnel files to verify full compliance with all State

regulations.3

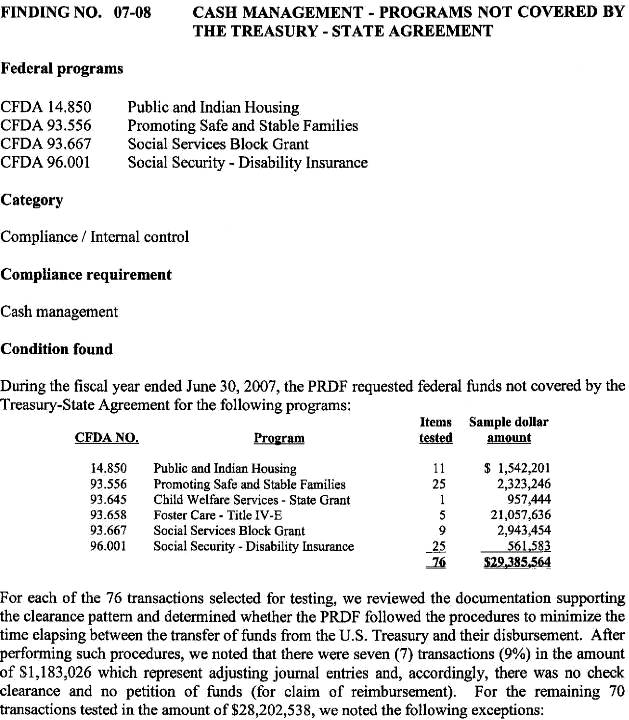

5.

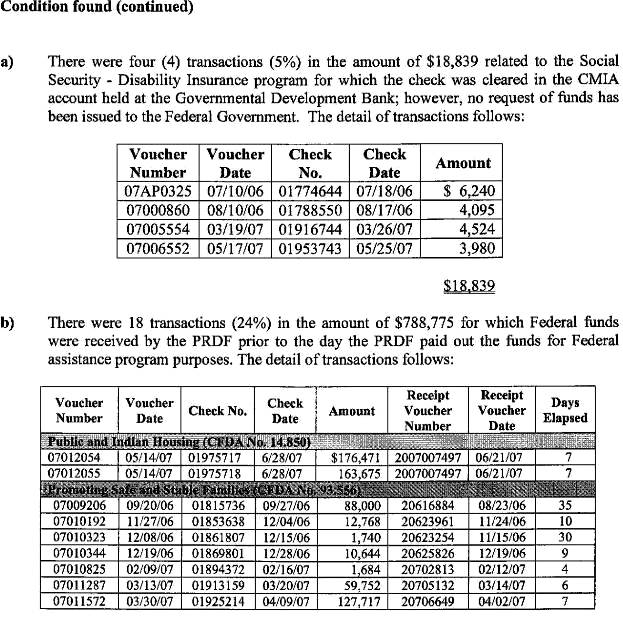

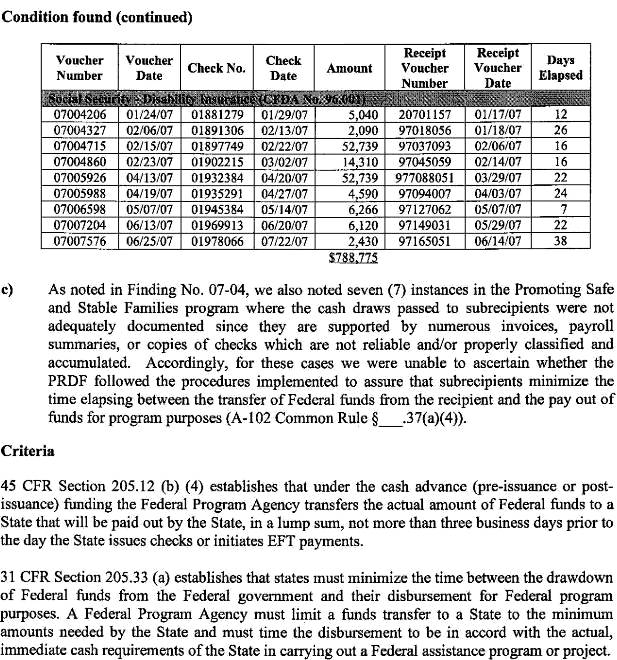

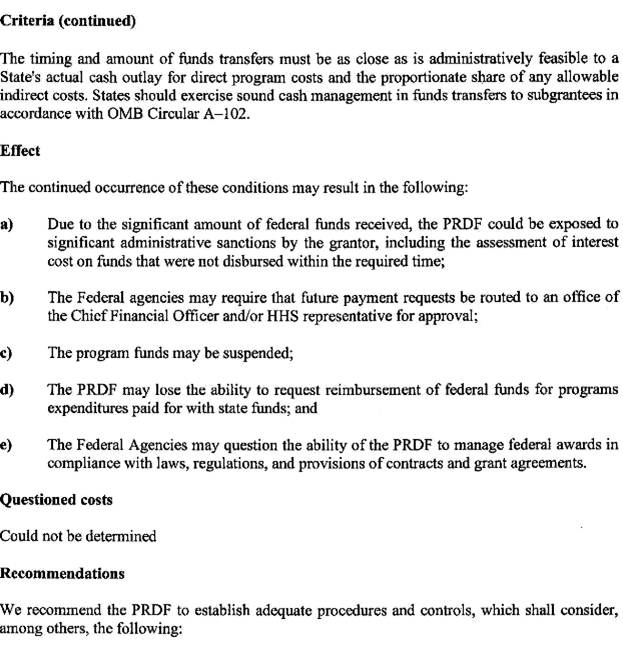

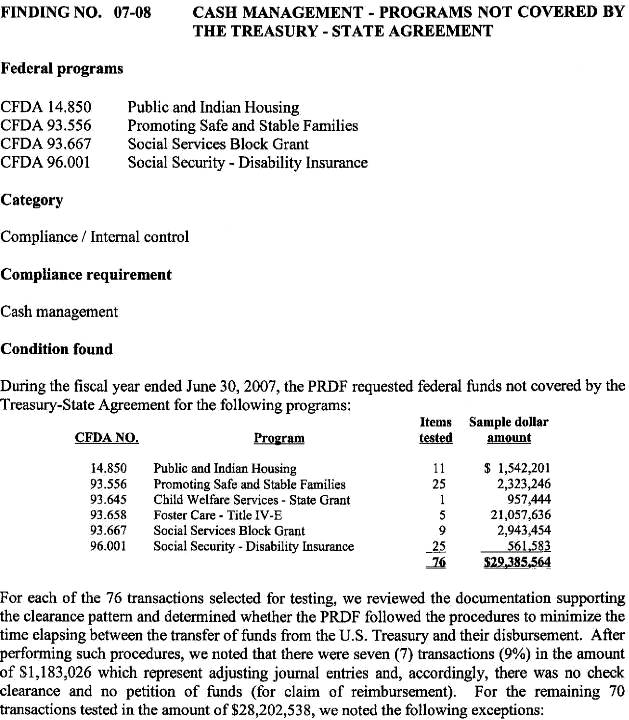

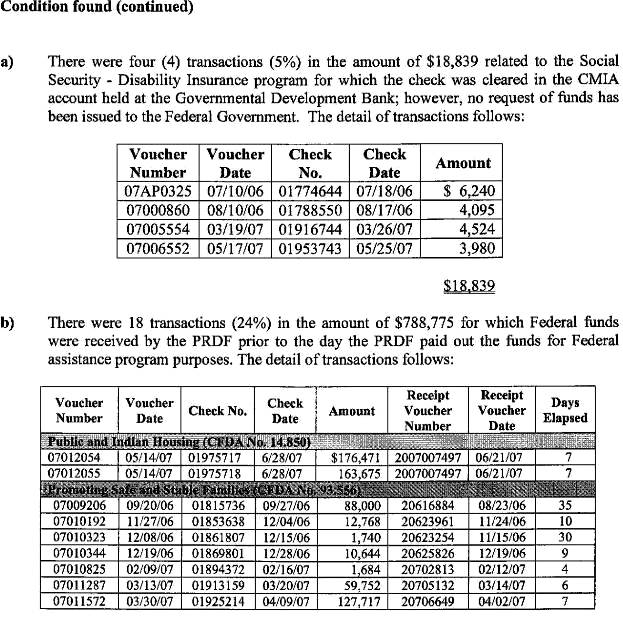

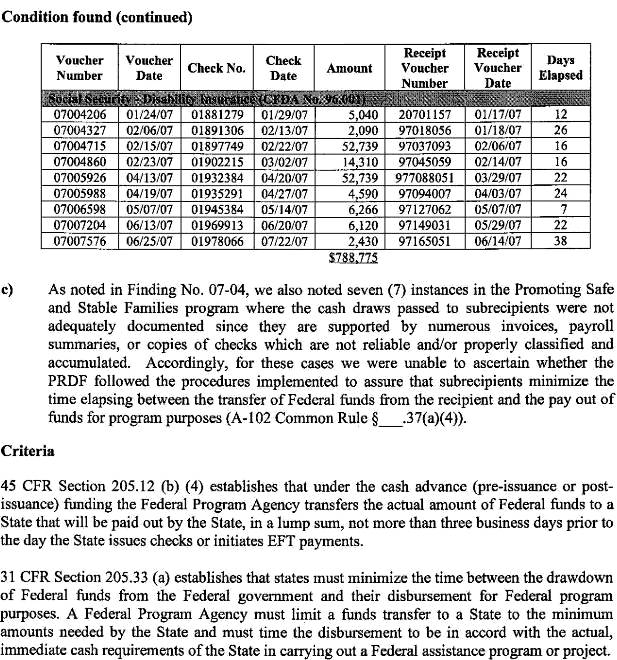

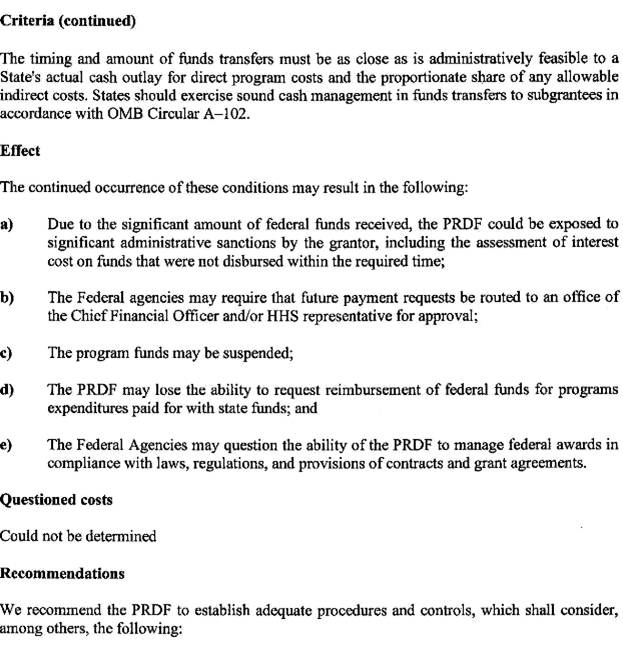

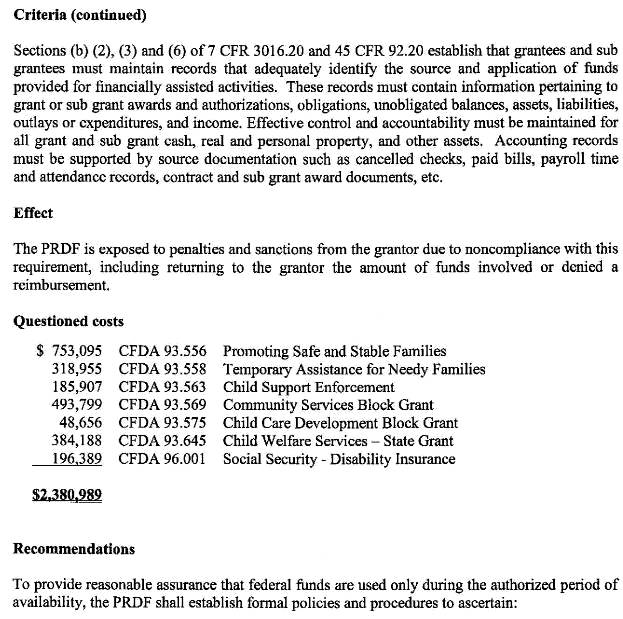

Did not have adequate procedures and

controls over the timing of cash draws for SSA’s disability program and

therefore was not in compliance with OMB Circular A-102 (see Attachment A,

Pages 11 through 15). PRDF

disagreed with this finding; therefore, no corrective action was indicated in

the report.

6.

Did not have an effective property and

equipment system (Attachment A, Page 16 through 18). The corrective action plan indicated that PRDF was developing

a customized automated Property Management System.3

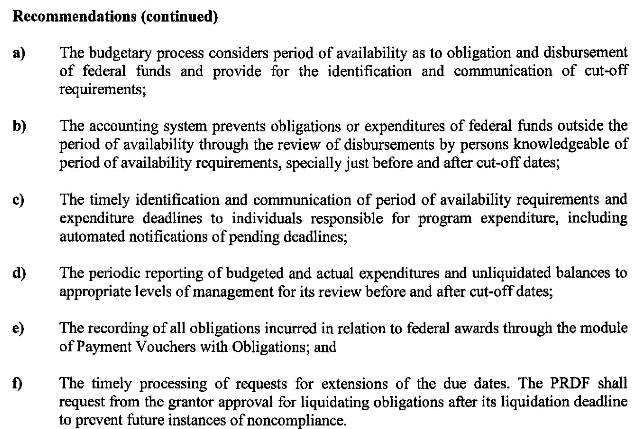

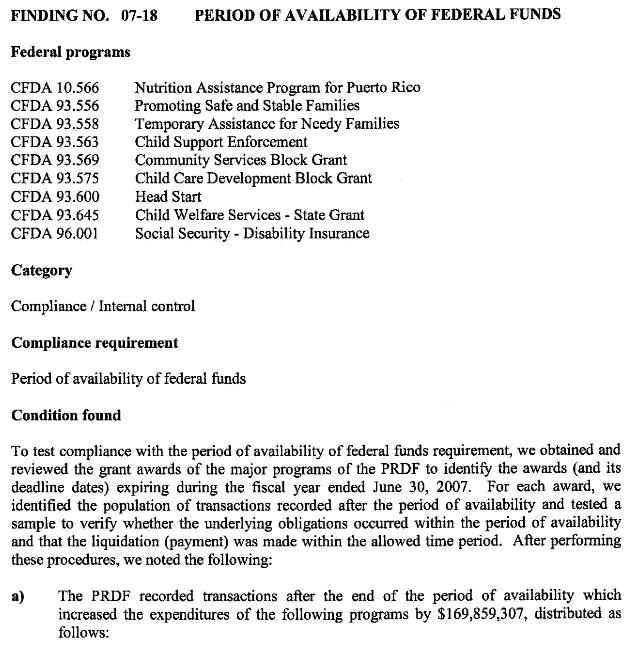

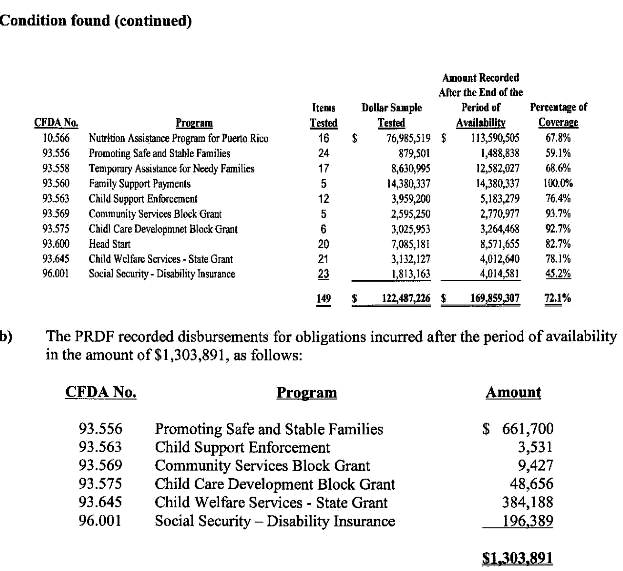

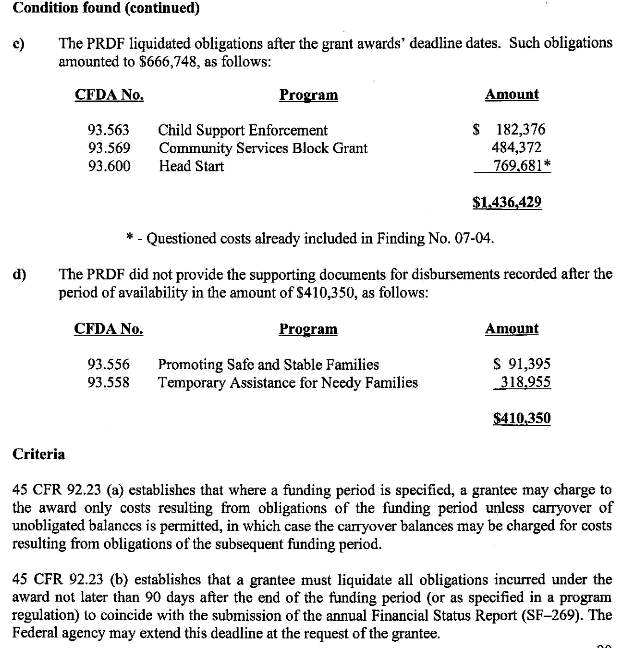

7.

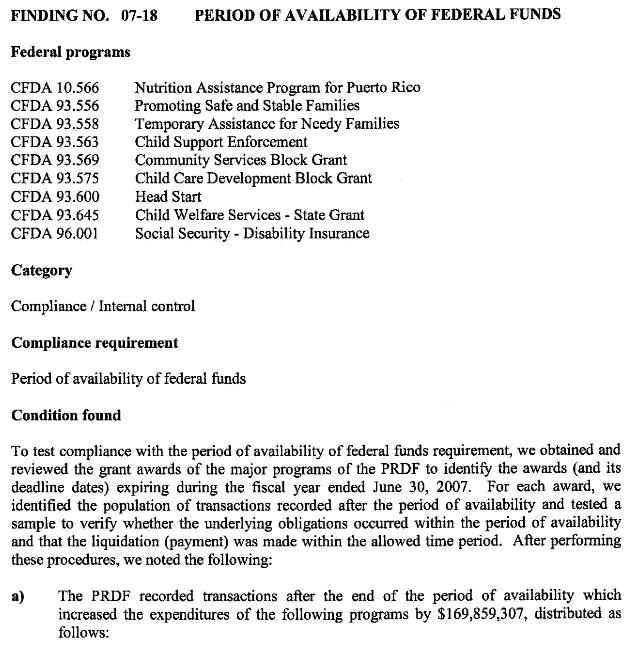

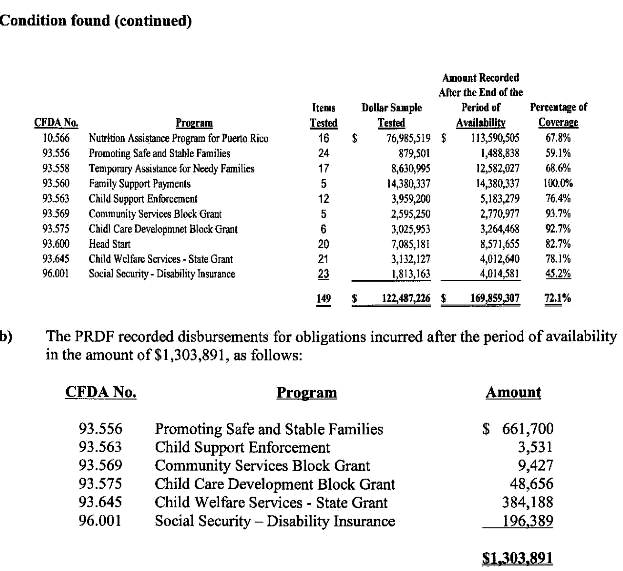

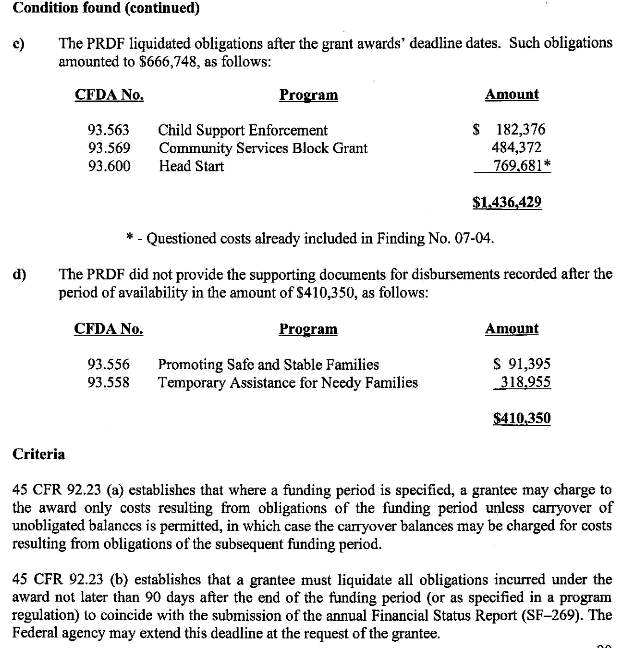

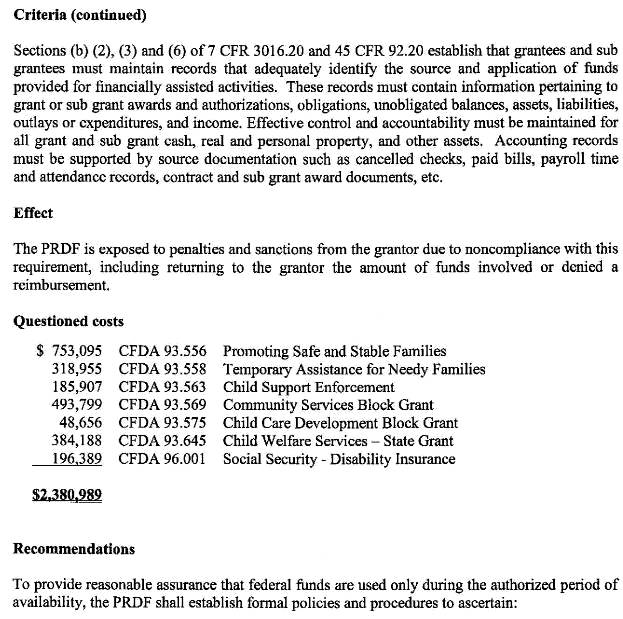

Charged expenditures totaling $196,389 to

SSA for obligations that were incurred after the end of the period of

availability (see Attachment A, Pages 19 through 23). The corrective action plan indicates PRDF will implement a

mechanized application of budget control and financial transaction's register

for Federal and State funds that will facilitate fiscal compliance with Federal

regulations.

We recommend that SSA:

1.

Ensure PRDF’s cash draws for SSA’s

disability program are in accordance with OMB Circular A-102.

2.

Determine whether obligations recorded after

the period of availability resulted in unallowable charges and if so, request a

refund of the unallowable costs.

Please send copies of the

final Audit Clearance Document to Ken Bennett.

If you have questions contact Ken Bennett at (816) 221‑0315

extension 1558.

Patrick

P. O’Carroll, Jr.

Attachments

Overview of the Office of the Inspector General

The Office of the Inspector General (OIG) is comprised of an

Office of Audit (OA), Office of Investigations (OI), Office of the Counsel to

the Inspector General (OCIG), Office of External Relations (OER), and Office of

Technology and Resource Management (OTRM).

To ensure compliance with policies and procedures, internal controls,

and professional standards, the OIG also has a comprehensive Professional

Responsibility and Quality Assurance program.

Office of Audit

OA conducts financial and performance audits of the Social

Security Administration’s (SSA) programs and operations and makes

recommendations to ensure program objectives are achieved effectively and

efficiently. Financial audits assess

whether SSA’s financial statements fairly present SSA’s financial position,

results of operations, and cash flow.

Performance audits review the economy, efficiency, and effectiveness of

SSA’s programs and operations. OA also

conducts short-term management reviews and program evaluations on issues of

concern to SSA, Congress, and the general public.

Office of Investigations

OI conducts investigations related to fraud, waste, abuse, and

mismanagement in SSA programs and operations.

This includes wrongdoing by applicants, beneficiaries, contractors,

third parties, or SSA employees performing their official duties. This office serves as liaison to the Department

of Justice on all matters relating to the investigation of SSA programs and

personnel. OI also conducts joint

investigations with other Federal, State, and local law enforcement agencies.

Office of the Counsel to the Inspector General

OCIG provides independent legal advice and counsel to the IG on

various matters, including statutes, regulations, legislation, and policy

directives. OCIG also advises the IG on

investigative procedures and techniques, as well as on legal implications and

conclusions to be drawn from audit and investigative material. Also, OCIG administers the Civil Monetary

Penalty program.

Office of External Relations

OER manages OIG’s external and public affairs programs, and serves

as the principal advisor on news releases and in providing information to the

various news reporting services. OER

develops OIG’s media and public information policies, directs OIG’s external

and public affairs programs, and serves as the primary contact for those

seeking information about OIG. OER

prepares OIG publications, speeches, and presentations to internal and external

organizations, and responds to Congressional correspondence.

Office of Technology and Resource Management

OTRM supports OIG by providing information management and systems

security. OTRM also coordinates OIG’s

budget, procurement, telecommunications, facilities, and human resources. In addition, OTRM is the focal point for

OIG’s strategic planning function, and the development and monitoring of

performance measures. In addition, OTRM receives

and assigns for action allegations of criminal and administrative violations of

Social Security laws, identifies fugitives receiving benefit payments from SSA,

and provides technological assistance to investigations.

[1] In January 2009, the President’s Council on Integrity and Efficiency was superseded by the Council of the Inspectors General on Integrity and Efficiency, Inspector General Reform Act of 2008, Pub. L. No. 110‑409 § 7, 5 U.S.C. App. 3 § 11.

[2] The corrective action plans contained in the Single

Audit of the

[3]

This finding and

OIG’s recommendation were reported in the Management Advisory Report: Single Audit of the